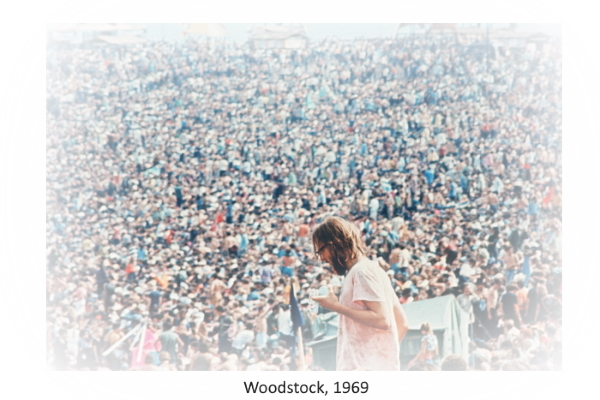

1969. The Summer of Love.

Woodstock may be the prime example in our lifetimes. Not a trickle, not a gathering, but rather a throng, responding, flocking, packing in by the tens—no hundreds—of thousands, for the chance to participate in a great unknown. It turned out amazing. They even got "breakfast in bed for 300,000."

It might surprise you to know, but a few hundred thousand is literally a drop in the bucket, compared to the multitudes of US who crowd in by the millions, all to join in today's "Great Unknown." It's so big, it is actually approaching 1/5 of the entire American economy. The Healthcare industry is so huge, it now vies for the biggest share of what we spend: more than taxes, more than rent or mortgage, transportation, maybe even more than food.

You don't agree? Just take a quick look at your paystub—most don't even give it a glance anymore—and see what is being deducted for "Health Insurance." If you dare, look at the cumulative total towards the end of the year; then refresh your knowledge on what amount your employer pays to complement what you pay. If you do a bit more research, you'll be shocked to discover how much both your and your employer's contributions have gone up over the past several years. But hey, "it's before taxes..." we all tell ourselves.

Many are disillusioned over the lack of payraises, not keeping up with the rising cost of...everything. But look at that deduction: there's where the payraise went. It's been there all the time. It's the extra amount you would be making if you—and your employer—didn't have to feed this increasingly voracious behemoth.

But then, if something should happen, even something fairly routine (bone break, hernia, torn ligament, etc.) requiring tests or imaging, an operation, or treatment like Physical Therapy, you'll find out that in our Woodstock, there's no music, blankets, or breakfast in bed. There's the DEDUCTIBLE that goes with those sky-high premiums. I mean, deductibles and high premiums now go together like...peas and carrots.

This is all glaringly laid-bare right now, in our time of pandemic, when even the unknown rules of this highly-planned but nevertheless opague system are turned inside-out. "Oh, they're covering everything!" is a Covid-myth that's been echoed far and wide. The reality of Coronavirus charges, coverage and lack thereof is not unknown to New York Times Healthcare reporter Sarah Kliff.

Sarah has been a consumer advocate-hero, doing yeomen's work gathering stories and data to back up people's accounts from all over the country on how Covid-19 is unfolding as both a Healthcare AND an economic calamity of as-yet-to-be assayed depths. Just one simple story of two friends who planned a trip and prepared by getting tested AT THE SAME SITE reveals much: https://rb.gy/e9bosy.

After a moment of righteous outrage over what happened to Pam LeBlanc and Jimmy Harvey, please be aware that DOC$ was founded to bring a new era of sanity, transparency, and competitive pressure to this preposterous reality. So do the throngs a huge solid: tell some friends, family, and colleagues about us, and share our posts, blog, and site.

For the time being, Opague may be the word for 2020.

Know the Cost of Healthcare Before You Go In! (especially now)