Short-selling is a risky strategy to make money. Yeah, it's messy: you gotta borrow the money to SELL the shares YOU DON'T EVEN OWN. Then wait and hope, hope, hope those shares go down, down, down! Otherwise, you know...you're really screwed...and yes, to the third power. On the other hand, if you're already mega-all-set, you don't need to borrow, and it won't hurt so much if you lose out on the trade. That's not most of us.

Give DOC$ a few minutes to illustrate how you can literally rig the short-selling game in your favor when it comes to pre-planned medical expense purchases.

There's been a flurry of research into all those prices hospitals everywhere in the United States now have to publish, the result of a new law passed by Congress at the end of last year. Yes, THOSE hospital prices that are SO EASY TO FIND...yeah, right! We've looked into those, from hospitals in cities all over the country. What we've found are buried, obscured, obfuscated, tower-of-babel-made-inscrutable hieroglyphs. On purpose, or course.

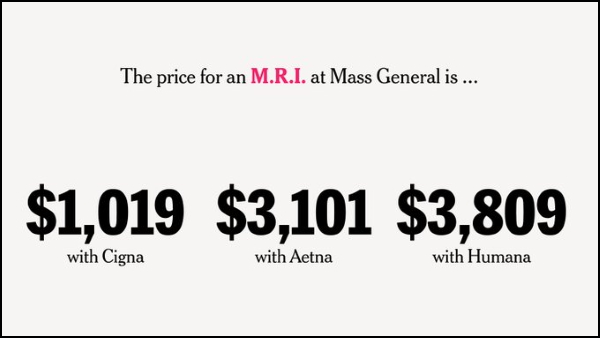

Your friendly local hospital DOES NOT WANT YOU TO KNOW the price of anything until AFTER you have made your purchase. In this regard, your insurer won't be much help either. Shocking, yes. So the New York Times' Sarah Kliff's latest reading of the hospital tea-leaves has raised some eye brows, some hackles, and much interest from a throng of prominent Healthcare Economists.

According to the graphic above, these are the prices for an MRI (no way to know what type of MRI) at Boston's Mass General. These are the prices WITH insurance discount applied. No wonder they don't want you to know the price in advance—they defined as your insurance company, in this case. As the saying goes, "With friends like these..." Shocking as it may seem, one of the findings of the NYT research: Insured discounted prices may actually be more than uninsured, "cash-pay" customer prices. Let's make sure everyone's got that: You may pay more WITH insurance than without.

We can probably all agree to dispense with all those assurances that "Oh, nobody actually PAYS those prices." That's probably bad enough news for most people, but if you're a glutton for punishment, then consider: this is the type of "insured" expense that falls under your annual per-patient deductible. How much is yours?

Now, some good news—and you don't even have to sit though one of those endless videos by "Dr. Paul Hohumscarem" to get it. Let's return briefly to "the parable of the short-seller." In many U.S. cities and communities, you can forget your pricey hospital (short-sell them) and find a local imaging clinic who will do your doctor-ordered MRI for as low as $275-300! (I am loathe to over-explain, but here goes: You've bought back in for around 10%, and pocketed the difference. Short-sell accomplished!)

Yes, even in places like Los Angeles, Chicago, Philadelphia and Boston, you can find a quality, reputable imager for a great bargain. If you are a benefits coordinator, or HR professional for a medium or large company who self-insures, why would you ever let your workers go out unequipped with this vital information that can literally save their finances and/or your company's healthcare budget? Of course you wouldn't.

You can already find some of these Providers and their very competitive prices right here on DOC$. You'll need to sign up to use our service, but 1) it's free, and 2) you can both browse and contribute to our data anonamously by creating a username.

Know the Cost of Healthcare BEFORE You Go In!